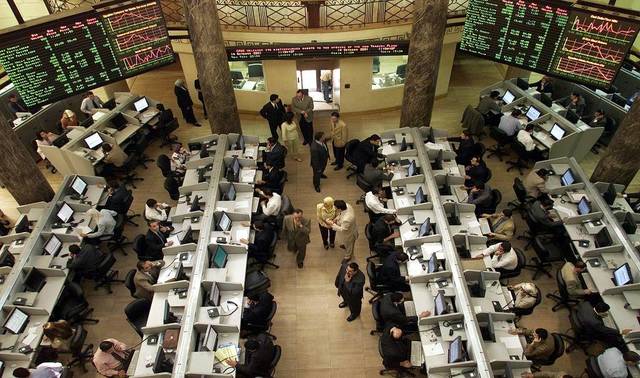

Cairo – Mubasher: The Egyptian Exchange (EGX) suffered a sharp drop in the week which ended 23 February after its benchmark index EGX30 plunged 3.25% or 411.4 points and closed at 12,240.5 points.

Market capitalisation lost EGP 15 billion over the week to end at EGP 600.3 billion.

This week witnessed various talks by government bodies on the stamp duty tax that will be imposed on EGX transactions. Officials have said that the tax was likely to reach 0.002% for both buyers and sellers.

The EGX’s heavyweight Commercial International Bank – Egypt (CIB) tumbled 4.28% to EGP 73.85, following a weekly turnover of EGP 492.76 million.

The EGX30 index succeeded in reaching 12,714 points this week; however, selling pressures reemerged to bring the index below the support level of 12,300 points, Sameh Gharib, head of technical analysis at Roots Brokerage, commented.

A break below 12,200 will push the index towards further declines starting at 12,000 then towards 11,800 points, the analyst said, noting that on the other hand, 12,500 has become the closest resistance level followed by 12,700 points.

Meanwhile, the EGX70 index fell 5.5% to 483.68 points, while the EGX100 and EGX50 indices retreated 4.66% and 1.55% to 1,163.29 points and 1,927.2 points, respectively.

Commenting on the EGX70’s performance, Gharib noted that the index suffered profit-taking at the resistance level of 530 points, which brought it down towards support at 480 points.

It is expected that the index will attempt to keep its position above 480 points and rise towards the next resistance levels of 500 and 520, the analyst added.

Foreign and Arab investors were mostly sellers, netting EGP 3.1 billion and EGP 236 million, respectively, whereas Egyptian investors were buyers, netting EGP 3.35 billion.

Retail investors sold stocks at a net of EGP 525.4 million, while institutional investors were mostly buyers.