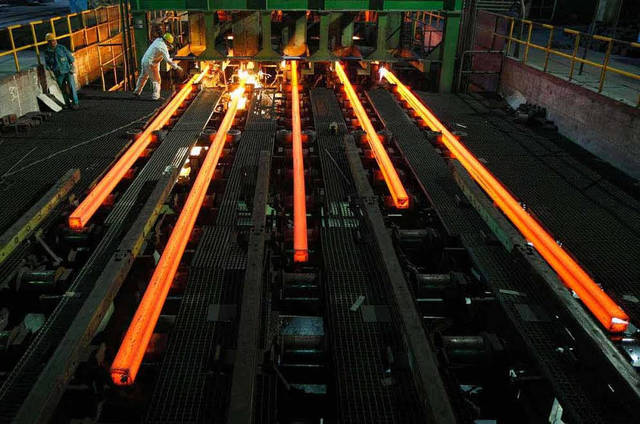

Mubasher: Global steel demand is expected to rise 2.1% to 1.657 billion tonnes (Bt) for this year compared to the last year, while it would grow 1.4% for the next year to a total of 1.681 Bt, according to the World Steel Association (worldsteel).

“In 2018, global steel demand continued to show resilience supported by the recovery in investment activities in developed economies and the improved performance of emerging economies,” chairman of worldsteel economic committee Emirates Steel CEO Saeed Ghumran Al Remeithi said in the association’s short range outlook report.

While an upturn in the steel demand was carried over to this year, risks have also intensified, Al Remeithi noted.

“Rising trade tensions and volatile currency movements are increasing uncertainty, [and] normalization of monetary policies in the US and EU could also influence the currencies of emerging economies” Al Remeithi noted.

Middle East

Demand in Middle East countries rose 2.1% to a total of 54.5 million tonnes (Mt) in the current year, while it is projected to rise by 1.2% to 55.1 Mt.

This was helped by structural reforms and rising oil prices have provided demand growth momentum in the Gulf states, Al Remeithi said.

Developed economies

Steel demand in the developed countries is set to grow by 1% this year and 1.2% in the next.

In the US, demand grew strongly last year driven by resilient consumer spending and business investment which was ramped up by changes in taxes and regulations, as well as financial stimulus, despite a modest growth of the construction activity.

Demand for steel would decelerate in the US as activity expansion in the automotive industry and construction sector would slow down.

Mostly driven by domestic orders, the broad-based recovery in steel demand growth in the European Union (EU) would continue, though at a subdued pace.

Although the economic fundamentals in the bloc remained relatively healthy, steel demand growth for the next year would lose pace year-on-year, in part due to anxieties resulting from global trade disputes, according to the report.

Emerging economies

Turkish steel demand is set to shrink for this year in the wake of the currency crisis, yet stabilising measures and a return to the competitiveness of its Turkey’s manufacturing sector are set to help recovery for the next year.

In Russia, steel demand growth is projected to wane, despite rising oil prices.

Meanwhile, improving investment and infrastructure projects would help demand in India return to growth again, as the Asian nation recovers from the blows from demonetisation and the implementation of goods and services tax (GST).

China

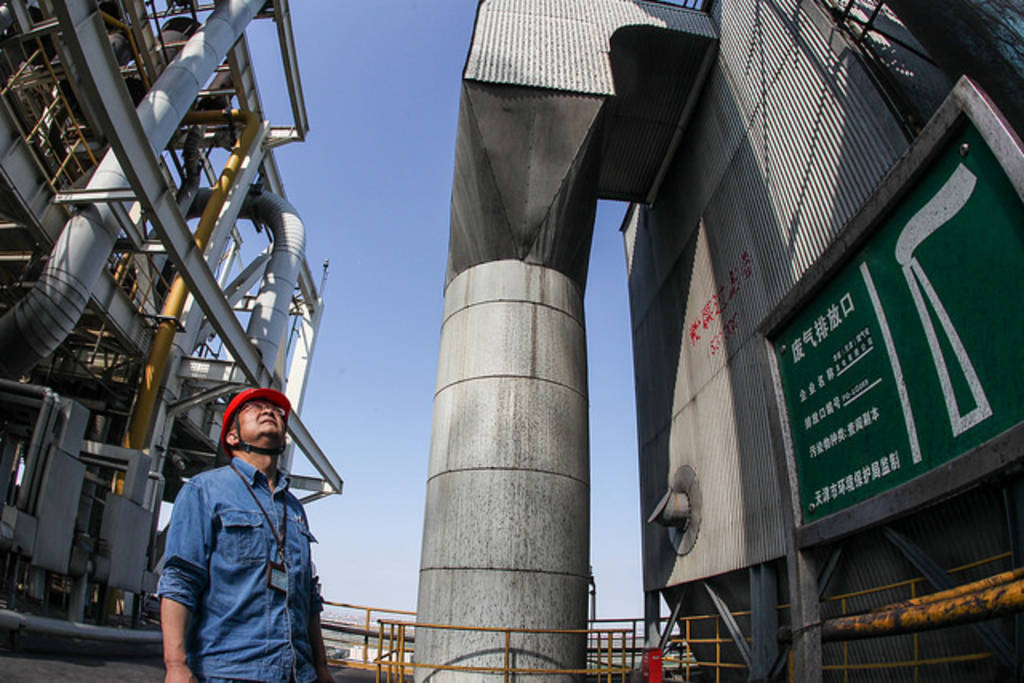

In the world’s second largest economy, steel demand was buttressed by the mini stimulus in real estate market and strong global economy during the first half of this year.

Nevertheless, as the government exerted rebalancing efforts and tightening environmental regulations, demand would fade towards the end of this year and the next.

Downside risks for China were ascribed to the continuing trade tension with the US and a slowdown in the world’s economic growth.

That said, if Beijing decides to use stimulus measures to cushion the looming slowdown of Chinese economy, facing a worsening economic conditions, demand would be boosted in the next year.

Japan and Korea

Steel demand for Japan would remain firm due to investment catalysts, due to record high earnings for companies and the continued loose monetary policy, and demand related to the Tokyo Olympics.

For Korea, demand would shrink further this year with difficulties in steel consuming sectors, while it would see a fractional recovery in the next year.