Mubasher: Oil markets may be able to adjust to US sanctions against Venezuela’s hydrocarbon industry, according to the International Energy Agency (IEA).

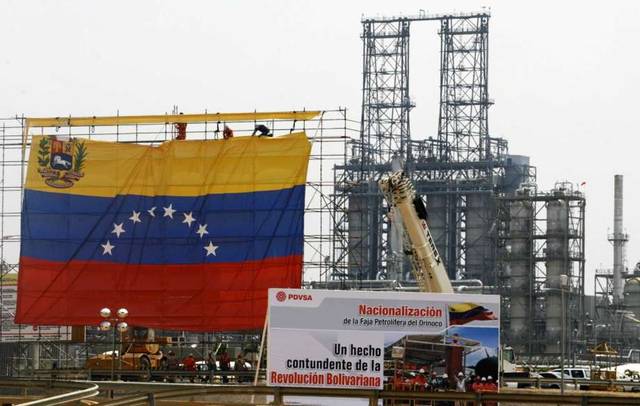

Washington slapped the Latin American nation’s state-owned oil firm Petroleos de Venezuela (PdVSA), in an attempt to block President Nicholas Maduro’s access to oil revenue.

“The imposition of sanctions by the US against Venezuela's state oil company Petroleos de Venezuela is another reminder of the huge importance for oil of political events,” the IEA said in its closely-watched report on Tuesday.

However, headline benchmark oil contracts barely saw a change on the back of the sanctions, because “in terms of crude oil quantity, markets may be able to adjust after initial logistical dislocations,” the Paris-based agency noted.

Global benchmark Brent crude gradually pared some of its losses, since sliding over 40% between early October and late December last year.

Production issues in Venezuela and supply curbs by the Organization of Petroleum Exporting Countries (OPEC) from the beginning of this year have also shored up oil futures in recent weeks.

Crude prices did not see a very “alarming” surge since the US administration hit Venezuela with sanctions, because the market is still working off the surpluses built up during the second half of this year, the energy watchdog said, adding that global supply was estimated then to have outpaced demand by 1.3 million barrels per day (bpd).

“Crude oil quality is another issue, and, in the wider context of supply in the early part of 2019, it is even more important,” the IEA said.

Venezuela, with the world’s biggest oil reserves, typically produces heavy crude which is more difficult to refine and usually contains large quantities of sulfur and other impurities that are costly to remove.

Sanctions would prevent the large amounts of naphtha, which the US exported to Venezuela to dilute its ultra-heavy oil, and that would result in “a tough job [for PdVSA] to make enough spec barrels available for export,” the agency said.

“In quantity terms, in 2019 the US alone will grow its crude oil production by more than Venezuela's current output,” the IEA noted, adding that “in quality terms, it is more complicated.”

In the two weeks since the sanctions were in place, Venezuela’s crude shipments reportedly diminished and shifted toward cash-paying importers such as India.