Mubasher: Gold prices dipped on Wednesday amid re-kindled hopes of a trade deal between the US and China and dovish signals from the European Central Bank (ECB), all of which boosted risk-taking appetite, Reuters reported.

In the meantime, all eyes are on the outcome of the US Federal Reserve’s two-day policy meeting due later in the day.

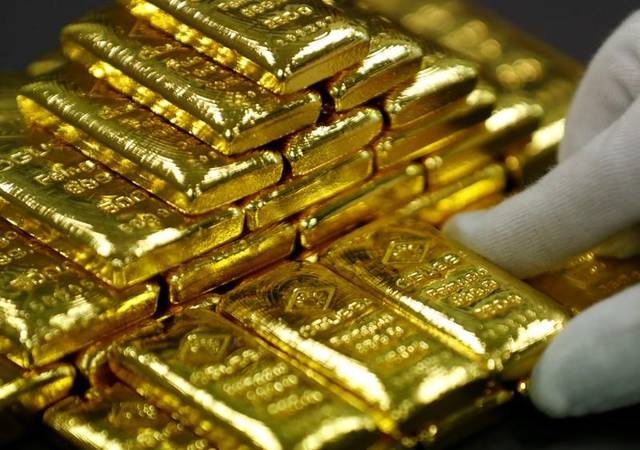

By 9:16 am GMT, spot gold fell by 0.29% to $1,342.69 per ounce, while US gold futures dropped by 0.34% to $1,346.10 per ounce.

Equities rallied after the news that the US will resume talks with China as investors expected that the Fed would follow its European peer and pave the way for future rate cuts at its policy meeting.

“We have equity markets surging because of Trump tweet last night, which has taken a lot of the scepticism out of the market,” SPI Asset Management managing partner Stephen Innes was quoted by Reuters.

President Donald Trump said via Twitter that US and Chinese teams were preparing for his meeting with Xi Jinping on the sidelines of the Group of 20 (G20) summit in Japan next week.

In addition, the US central bank is expected to stick to its monetary policy this time, but it would open the door for a future cut to the costs of borrowing at its next meeting in July.

Philip Futures urged investors to temper their bullish bets on the yellow metal as an upturn in appetite for riskier assets driven by a dovish monetary approach should rein in gains for the non-yielding bullion, the news agency said.

The US dollar hovered near its highest level seen since two weeks, buoyed by dovish signals from the ECB and soft Eurozone economic data.

At 9:21 am GMT, the dollar index, which gauges the US currency against a basket of six key rivals, edged down by 0.04% to 97.60.

“If the Fed comes out dovish or more dovish or as dovish as markets are pricing, it will weaken the US dollar, which will add to gold’s allure,” SPI Asset Management’s Innes said.