2222

Riyadh – Mubasher: Listing and trading the shares of the Saudi Arabian Oil Company (Saudi Aramco) began today on the Saudi Stock Exchange (Tadawul), following the largest initial public offering (IPO) the world has ever seen.

Minutes after trading the Aramco stock began, the Saudi oil giant reached a market capitalization of around $1.88 trillion, beating Apple’s $1.19 trillion value to become the world’s biggest listed company.

Aramco successfully attained around $25.6 billion from the IPO, with a share price of SAR 32 ($8.5), making the offering the largest in the history of the Saudi market and the world, surpassing Alibaba’s $21-25 billion.

Earlier today, the Aramco share surged by 10%, its daily fluctuation limit, as its first trading session began, rising to SAR 35.2 ($9.4), up from SAR 32, the final share price chosen for Aramco last week.

The world's biggest oil company set a share price range of SAR 30-32 before the IPO process began, then opted for the highest price due to increased demand.

Tadawul announced on Wednesday that it would extend the opening auction session on the first day of trading Saudi Aramco for half an hour.

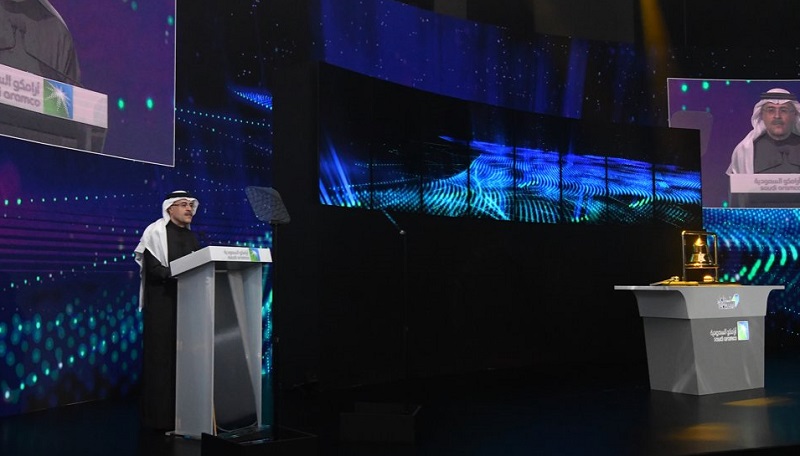

Amin Nasser, President and CEO of Aramco, said that the company is taking a new step after a journey of more than 86 years, adding during a celebration by Tadawul that the Aramco IPO represents the cornerstone of the Saudi Vision 2030.

Working on this step began in 2016 when Saudi Crown Prince Mohamed bin Salman revealed the intent to offer a stake in Aramco. Today we are making history and proud of this historical moment, Nasser added.

We have the advantage of low-cost production, trusted reserves, and we shall work to maintain our operational approach and financial discipline.

Chairwoman of Tadawul Sarah Al Suhaimi said that Aramco, following its successful IPO, is becoming the largest listed company in the world, with the Saudi exchange anticipating the listing of Aramco to make it among the biggest 10 stock markets around the globe.

Meanwhile, Yasir Al Rumayyan, Chairman of Aramco and Governor of the Saudi Public Investment Fund (PIF), said that the listing will help the company improve its governance and enhance transparency standards.

Choosing Tadawul for listing Aramco witnessed the high-level of the Saudi exchange, he added.

It is worth noting that Aramco offered 300 million shares, 1.5% of the company’s total capital through what became the world’s largest IPO.

IPO lead manager, Samba Capital, revealed on Wednesday that the institutional tranche saw an oversubscription of 620% for the offered two billion shares amounting to SAR 64 billion, while the retail tranche was oversubscribed with aggregate subscriptions amounting to SAR 446 billion representing coverage of 465%. The number of individual subscribers was 5.056 million, with a total subscription value of SAR 49.2 billion.