Mubasher: The Arab fund markets, including Saudi Arabia, the UAE, Kuwait, Bahrain, Oman, and Qatar, witnessed total net inflows of $2.5 billion during the first half of 2019, according to Refinitiv Lipper Data.

These inflows took place amid a volatile but positive market that saw talks about a likely trade war between the US and China, a risk of renewed crisis in the Eurozone with the recent developments in France and Italy, and an economic slowdown with the sliding earnings of companies, a statement released by Refinitiv showed on Wednesday.

However, mutual funds are expected to see net inflows as equity markets experienced a recovery during the six-month period ended 30 June.

Total assets under management (AUM) in Arab fund markets rose to $32.4 billion year-to-date from $30.5 billion, supported by overall net sales of $2.5 billion, “while the performance of the underlying markets had a negative contribution of $0.6 billion to overall assets under management,” head of EMEA research at Lipper, Refinitiv, Detlef Glow said.

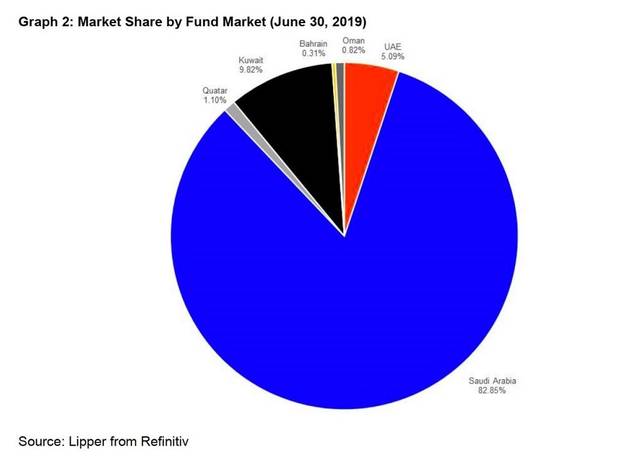

Saudi Arabia ranked first among Arab countries, by making up 82.85%, or $26.9 billion, of the overall AUM.

In the meantime, Kuwait accounted for $3.2 billion, or 9.82%, of the overall AUM, while the UAE made up $1.7 billion, or 5.09%, of the overall AUM.

In addition, Qatar, Oman, and Bahrain accounted for $0.4 billion, $0.3 billion, and $0.1 billion, respectively, of the overall AUM in the Arab fund markets.

Money market funds led other asset types in terms of the highest AUM, registering $20.2 billion at the end of last June, followed by equity funds, mixed-asset funds, bond funds, real estate fund, and commodity funds with $9.2 billion, $1.2 billion, $1.0 billion, $0.7 billion, and $0.002 billion, respectively.

Despite being a tough year with split results for Arab fund markets and asset managers, 2019 has been generally a positive year as mutual funds saw net inflows of $2.5 billion.