Riyadh – Mubasher: The initial public offering (IPO) of the Saudi Arabian Oil Company (Saudi Aramco) will likely to be positive for Saudi banks during the fourth quarter (Q4) of 2019 due to banking fees, however, Al Rajhi Capital Research expects it to be negative in 2020.

The negative impacts will be mostly on banks with a higher percentage of non-interest bearing deposits, as a portion of non-interest bearing deposits will change into interest-bearing deposits, the research firm said in a note on Monday.

The expectation is built on three main points, first, “incremental benefits to come from estimated one-time fees of around SAR 400 million and margin lending income of SAR 1.4 billion annually. Other longer-term benefits come from higher trading commissions as possibly trading volumes will increase as private/new money enters the listed space and some interest-bearing deposits move into equities,” according to Al Rajhi Capital.

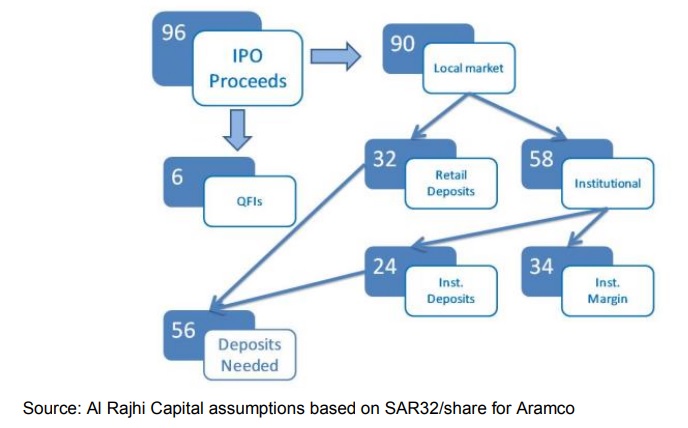

Secondly, the increased costs of SAR 34 billion margin lending at 4% is likely not enough to offset the increase in costs as SAR 56 billion go to the Public Investment Fund (PIF) and come back as SAR 90 billion interest-bearing deposits

Finally, if the PIF decides to move all the SAR 90 billion outside the Kingdom, this could increase the loan-to-deposit ratio (LDR) and foreign exchange reserves would decline as well.

Furthermore, it would require new local money supply/creation in the economy of around SAR 25 billion but the US dollar peg will still not be challenged. On the other hand, if PIF does not move IPO proceeds abroad, this will boost economic growth if invested locally, the report highlighted.

Al Rajhi said it assumes PIF’s IPO proceeds would come back to the system.