Mubasher: With the presidential and congressional elections in the United States right around the corner, Kamco Invest hosted a webinar on the economic and financial impact of the upcoming US elections, which will take place on 3 November, with representatives from New York Life Investment Management and Kamco Invest.

The most notable takeaways from the event are the potential impact on the US economy and global financial markets, oil markets, the US dollar, and trade wars.

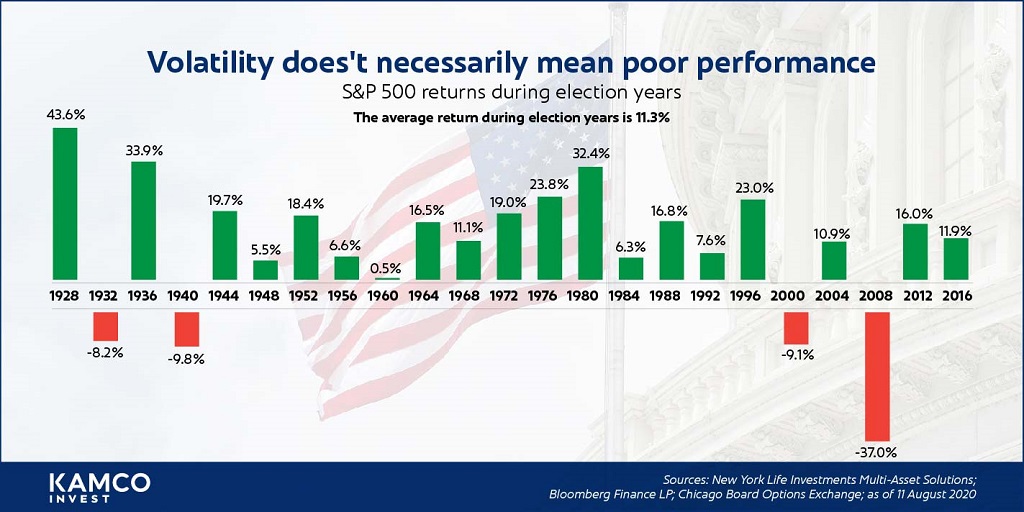

Historical data show that regardless of the outcome of the elections, markets predominantly performed positively following an election with the exception of some cases, such as the global financial crisis in 2008 and the burst of the dot-com bubble in 2000, Jae Yoon, Chief Investment Officer (CIO) of New York Life Investment Management, explained.

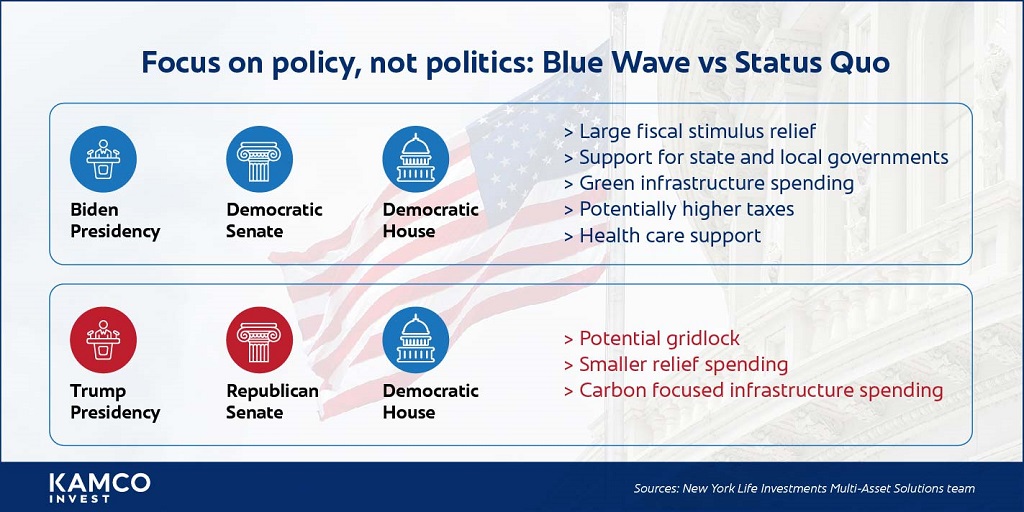

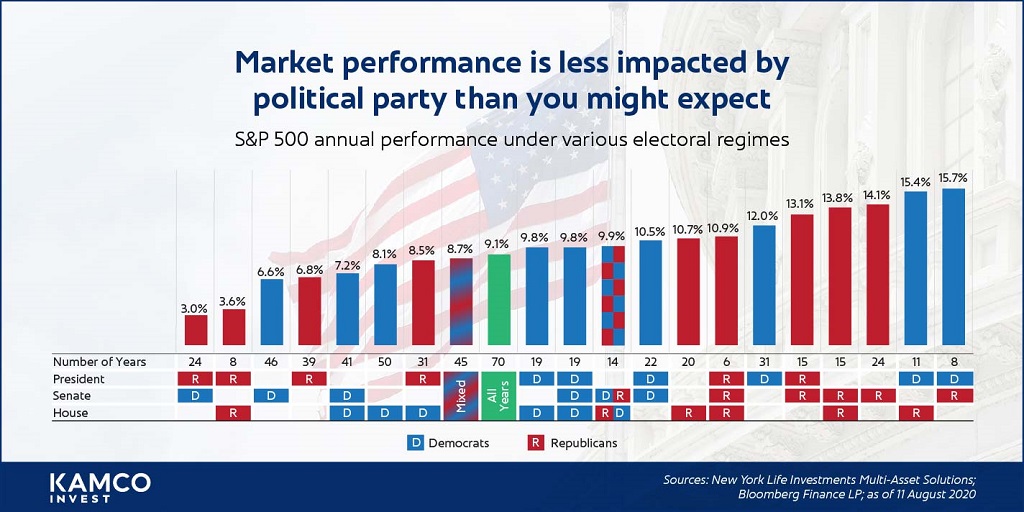

Moreover, market performance is less impacted by a specific political party than anyone might expect. However, investors anticipate a sizeable fiscal package following a “Blue Wave”, which is defined as a Democratic win of the presidency or the White House, the Senate and the House of Representatives, Yoon added. He further noted that regardless of the outcome, both party’s agendas include an increase in infrastructure spending, and state and local taxes could also go up under any party as well.

Historically, the S&P 500 index rose 11.3% on average during election years since the year 1928. Volatility tended to rise leading up to an election, but historically and on average, it tended to move lower after that. One expectation remaining constant is the fact that the Federal Reserve will maintain interest rates near zero for a long time. Expectations that interest rates will remain where they are until possibly 2024.

As for crude oil, both candidates will have the opposite impact on oil supply with Donald Trump most probably maintaining the current stance in support of the US oil industry.

The current situation with depressed oil prices is due to the high levels of inventories that were present even ahead of the COVID-19 pandemic, according to Ljubomir Krispinovic, Vice President, Equity and Fixed Income at Kamco Invest.

A Joe Biden win could impose pressure on oil in the form of government subsidies and increased environmental protection policies that will result in a reduction in the demand for oil and increased pressure on the US shale industry, Robert Serenbetz - Multi-Asset Portfolio Strategist at New York Life Investment Management, argued.

Yoon agreed and suggested one measure may be to limit drilling companies’ ability to operate on federal properties.

Meanwhile, Krispinovic noted that the support, or lack thereof, for the US shale industry would have a direct impact on our region. Further support means higher supply, putting pressure on prices and further deteriorating the advantage for the GCC. The lack of support for US shale producers will in return put positive pressure prices by curbing supply, which in turn will be positive for our region.

It was also noted that over the last decade, the weight of the energy sector in equity indices has fallen significantly from approximately 20% to a low single digit’s weight in the S&P 500 index. This could quite possibly change in the wake of an increase in oil prices at some point in the future once the supply and demand imbalance passes through.

As for the US dollar (USD), all speakers agreed that there is a clear and present pressure for the value of the dollar to decrease versus major currencies. The US dollar interest rate advantage has been eroded almost completely this year, removing the advantage of higher earnings would most likely accelerate the trend of a weaker USD.

A Democratic win could have some positive pressure on the USD should fiscal reform take effect in the form of higher corporate and other taxes.

One thing that all speakers agreed on was the trajectory of each candidate towards the subject of trade wars. The current Trump administration will surely demonstrate the same momentum on China and possibly Europe as well. A continuation in the escalation of trade tensions does not bode well for our regional economies. Quite simply, China is the biggest customer for Middle Eastern oil. Any disruption in trade could disrupt demand for oil.

On the other hand, a Joe Biden administration could surely bring the opposite of that but still carry its own risks to the region. Through the recovery of previous agreements abandoned by Trump, which could escalate regional geopolitical tensions as well.

The session moderator, Faisal Al Othman, Director of Third-Party Solutions at Kamco Invest, concluded the session by emphasizing the importance of contemplating the future to take necessary actions, noting that for every challenge there lies an opportunity.