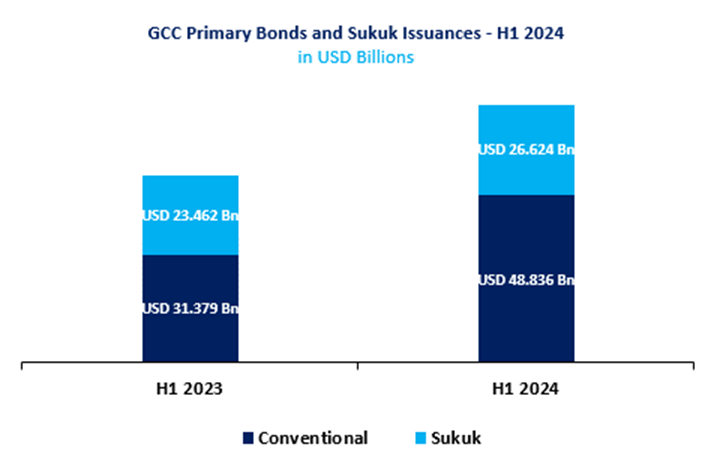

Mubasher: Primary debt issuances of bonds and sukuk in the Gulf Cooperation Council (GCC) countries surged to $75.50 billion in the first half (H1) of 2024, marking a 38% year-on-year (YoY) increase from $54.80 billion.

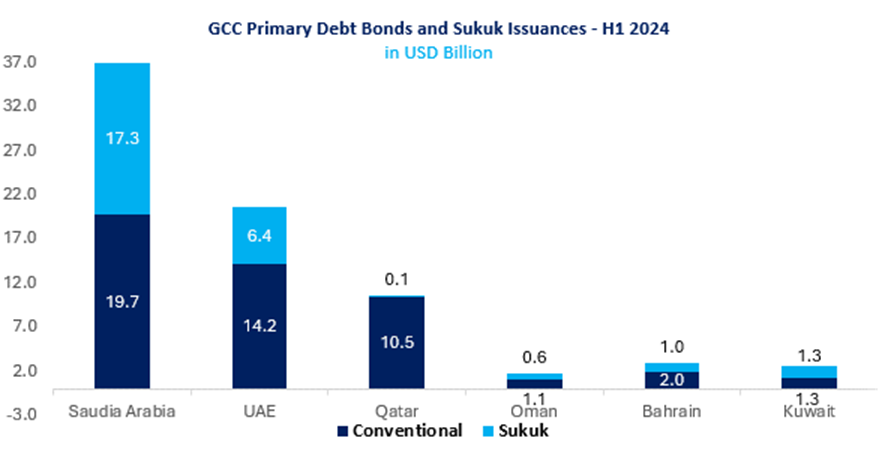

Saudi Arabia led the GCC bonds and sukuk market, raising $37 billion through 44 issuances, representing nearly half (49%) of the total value, according to a report by the Kuwait Financial Centre Markaz.

The UAE followed, securing $20.60 billion with 64 issuances, while Qatar raised $10.50 billion through 39 issuances.

Bahrain and Kuwait contributed $3 billion and $2.60 billion, respectively, while Oman issued $1.70 billion.

Sovereign entities dominated the market, accounting for 55% of the total value of primary issuances, amounting to $41.50 billion in H1-24, a 77% increase from H1-23.

Corporate issuances totaled $34 billion, representing 45% of the market and an 8% rise from the previous year.

Conventional bonds saw a significant uptick, with issuances rising 56% to $48.80 billion, making up 65% of the total market. Sukuk issuances increased by 14% YoY, reaching $26.60 billion and representing 35% of the total value.

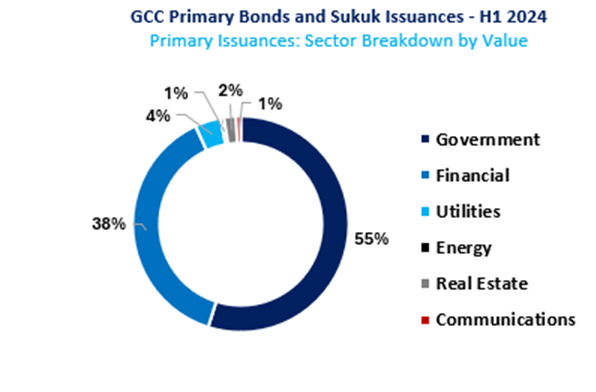

The government sector was the largest contributor, raising $41.50 billion, or 55% of the total value. The financial sector, including quasi-government entities, followed with $28.80 billion, representing 38%.

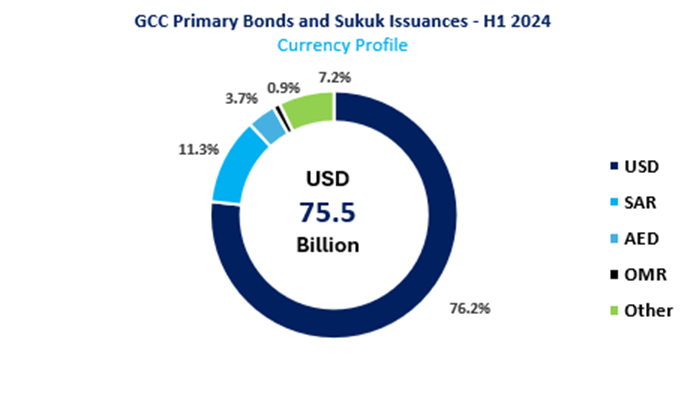

In terms of currency, USD-denominated issuances led the market, accounting for $57.50 billion, or 76% of the total value. SAR-denominated issuances followed with $8.50 billion, or 12%.

Rating agencies played a significant role, with 75% of GCC primary bonds and sukuk issuances rated by Standard & Poor’s, Moody’s, Fitch, or Capital Intelligence. Of these, 71% were rated within the Investment Grade category.